This is our annual analysis of the gold and silver markets. We look at the market players, dynamics, fallacies, drivers, and finally give our predictions for the prices of the metals over the coming year.

Introduction

Predicting the likely path of the prices of the metals in the near term is easy. Just look at the fundamentals. We calculate the gold fundamental price and the silver fundamental price (methodology described below) every day, and our data series goes back to 1996. Here is a graph showing the gold fundamental for three years.

Last year, with the price of gold around $1,575 our call was:

“We believe it is likely that gold will trade over $1,650 during 2020. We would not bet against it trading higher, perhaps much higher.”

As it turned out, the price briefly spiked over $2,000. Of course, that was the initial reaction of the market to the Covid lockdown. We did not predict Covid, but the fundamentals were pointing to a higher price. After the initial spike, the price subsided to a new level that is about $200 over our call.

A year ago, and with the price of silver around $18.30, we called for silver to hit $23.50 and a gold-silver ratio of 70. The price is now well over that, and the ratio is well below 70.

These calls weren’t bad, considering that for the long years after 2011 we got a reputation for being “permabears”.

Of course, the market price can diverge from the fundamental price, sometimes by a sizeable percentage and sometimes for a long period of time. And it tends to converge again, sooner or later. Right now, the market and the fundamental prices are $130 apart.

Since the Covid lockdown, the gold and especially silver basis have been reading artificially high (and thus their fundamental prices are too low). Because of logistics problems in delivering gold in the carry arbitrage, and because market makers are pulling out of the market, the high basis does not indicate high abundance of the metal. So we will not dwell further on our calculated fundamental price.

Anyways, to predict the price over the longer term, one cannot focus on the current basis too much. The basis shows the relative pressures in the spot and futures markets, but only a snapshot. It does not predict how those pressures might change. For that, one looks at the dollar of course, credit, interest rates, other currencies, the economy, and even wild cards like bitcoin.

In fourth grade math class, Miss Jennifer didn’t want the kids to just write “42” (with due respect to Douglas Adams). She wants to see the work all written out. It’s not so valuable if we say, “silver to $10” or “$100”, without saying why.

Below, we will show our "long division” work before getting to our bottom line numbers.

How Not to Think about Gold

It may seem odd to begin by discussing how not to do it.

However, there are some very common approaches that are very wrong, including analysis of retail bullion products, price manipulation conspiracy theories, rumors, out-of-context-factoids, or mining production and manufacturing consumption data.

Let’s talk about those for a moment.

At the time of this writing, it’s popular to juxtapose high retail product premiums with the drop in price, on days when the price falls. Advocates of this idea treat it as obvious, like a truck barreling down on you, that retail product premiums are the market. And therefore, if the price drops it proves that there is some kind of nefarious manipulation scheme.

We liken this to the idea that if the price of a mocha latte served in Midtown goes up, that the price of a 37,500 pound lot of coffee in Jakarta must be up. Or, there could be a more prosaic reason: perhaps Covid regulations have tripled the cost that goes into serving a cup of coffee.

Manufacturing capacity for products such as coins is limited and inelastic. If retail demand surges, as it has in the wake of Reddit-related activities, it can pull product out of the distribution channel. But after that, the price of coins has to surge to match demand to the supply.

This does not say anything about the global bullion market, which does not deal in 1-ounce coins. Just as the global coffee market does not deal in cups of mocha latte.

Obviously, persistent (as opposed to a one-day spike) retail demand will pull silver from the global bullion market. But it’s like pulling water from a 1000-gallon tank with a straw.

To learn about the additional approaches mentioned above, read the full Gold Outlook 2021, including our calls for the gold and silver prices (free registration required).

How We Think About Gold

The implications of this are extraordinary.

All of that stockpiled gold represents potential supply, under the right market conditions and at the right price. Conversely—unlike ordinary commodities—virtually everyone on the planet represents potential demand. If someone offered to pay you 1,000 barrels of oil, where would you put it? The same value of gold could easily fit in your pocket.

A change in the desire to hoard or dishoard gold, even a small one, can have a big impact on price.

There is no such thing as a glut in gold. Over thousands of years, the market has been absorbing whatever the miners put out. Gold mining does not collapse the gold price, as oil drilling or copper mining does, when inventories accumulate.

The whole point of gold is that inventories have been accumulating at least since the time of the ancient Egyptian Empire.

Why would people be willing—not just today, in the wake of the great financial crisis of 2008 and unconventional central bank response, but for thousands of years—go on accumulating gold and silver?

There is only one conceivable answer. It’s because these metals are money. Compare gold to oil. The marginal utility of oil—the value one places on the next barrel compared to the previous—declines rapidly. For oil, it falls rapidly because once your tank is full, you have that storage problem. Assuming you even directly use oil at all (and unless you are an oil refinery, you don’t).

People are happy to accept the 1,001st ounce of gold, on the same terms as the 1,000th or the 1st ounce. It doesn’t hurt that you could carry those 1000 ounces in a backpack, nor that you can find a ready market for it anywhere in the world, from London to Lisbon to Lagos to LA to Lima to Laos.

So if gold is money, then what’s the dollar? The dollar is a small slice of the US government’s debt. It is a promise to pay, though it comes with a disclaimer that says the promise will never be honored. The dollar is credit, whose quality is falling.

This turns our discussion of the gold price inside out.

The Paradigm Shift

We don’t look at it as most people do, that gold is worth $1,800. This is backwards, upside down, and inside out. It is like saying your meter stick is 143 gummy bears long. Instead, we insist that the dollar is worth 17.3 milligrams of gold. This is not merely semantics. It is a paradigm shift—easy to say, but harder to get your head around. The advantage of this perspective is that you can see the market much more clearly.

If you are in a rowboat, tossing about in stormy seas, would you say the lighthouse is going up and down? If you have rubbery gummy bears would you use them to measure a steel meter stick? Can you say that the steel is getting longer, as the gelatinous candy compresses? No, the lighthouse and steel are stable, while the waves and rubber band are not.

When you say “gold is going up”, you can’t help but think you are making a profit. But if you say “the dollar is dropping” then you realize the truth.

How We Analyze the Gold Market

We think of the market as the coming together of 5 different primary groups: buyers of metal, sellers of metal, buyers of paper, short sellers of paper, and market makers.

It's important to keep in mind that virtually all of the gold ever mined is in someone’s hoard. Again, there is no such thing as a glut or shortage. However, the market can experience relative abundance and scarcity and the spreads of the warehouseman provide a good signal to see it.

If there is a big spread between spot and futures—called the basis—then this means two things. One, speculators are bidding up futures contracts. And two, the marginal use of gold is to go into the warehouse. This is a sign that gold is abundant to the market.

Normally, the price in the futures market is higher than the price in the spot market. This is called contango. Contango means it is profitable to carry the metal, which is to buy a metal bar and sell a future against it. However, the basis spread can invert—and it has many times since the crisis of 2008. When it is inverted—called backwardation—it is profitable to sell metal and buy a future. Such decarrying is, by conventional standards, risk free (it’s not, see below). It should never happen in gold, as it is a sign of shortage and there is no such thing as a shortage in a metal which has been hoarded for millennia. Backwardation is a signal to the warehouseman to empty out the warehouse.

In backwardation, the marginal supply of metal is coming from the warehouse (carry trades are unwinding). Obviously, there is only a finite supply of gold held in carry. Thus, backwardation presages rising price.

This is the only way to analyze supply and demand fundamentals for the monetary metals. They are not consumed, and only accumulate over time. They have a stocks to flows ratio (i.e. inventory divided by annual mine output) measured in decades. As they’re not bought to consume, there is no particular price ceiling.

The five market participants interact to form a constantly changing dynamic. It is this dynamic that we study when we look at spreads between spot and futures, and changes to these spreads. Monetary Metals has developed a proprietary model based on this theory, which outputs the Fundamental Price for each metal. This is updated every day.

We have published more on the theory.

Macroeconomic Conditions

Last year, we wrote:

“As of the last writing of this annual market outlook, it was common belief that we are in for a period of rising prices and interest rates. We didn’t agree then, and we don’t agree now. The idea of rising rates is a bit less popular, now that the Fed has reversed itself and (so far) cut the effective Fed Funds rate by 80bps.”

And just like that—with the interest rate much lower than in 2018—this idea is now quite popular again. Indeed, one would be hard pressed to find anyone who doesn’t think rates will rise from here, along with consumer prices.

The mainstream view holds that bond buyers will demand higher rates as compensate for the loss of purchasing power that will come from the mass quantities of money printing.

We present several arguments against this view, published in the full Gold Outlook 2021, including our calls for the gold and silver prices (free registration required).

Not the Drivers of the Big Price Move

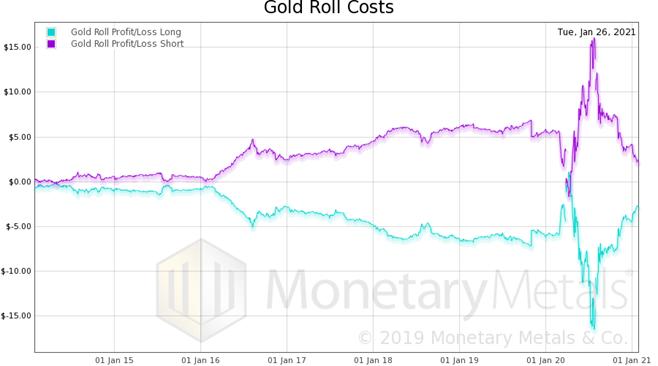

Speculators view gold and especially silver as just a vehicle to ride, to make more dollars. They can pull the price pretty far, at least for a while. Like stretching a big rubber band. However, it gets exhausting to keep up the force. Eventually, if they’ve gotten the trend wrong, they must let go. At some point, fatigue sets in (not to mention the cost of the keeping and rolling a futures position). Here is a graph of the cost of rolling a futures contract, showing seven years.

For long positions, look at the cyan line which is negative. For quite a while, it cost almost nothing to roll each futures contract, around 50 cents. The cost went up quite a lot, but has recently come down again. It is now around $3. A speculator had better expect a decent price move, to be willing to pay that cost at each contract roll (six time a year).

Monetary Metals

We are referring to our company here, not to promote it, but in the context of our discussion of the price of gold.

Many people have referred to buying gold as a non-expiring call option on a return to a gold standard. Once in a while, something comes along in the news about a policy proposal that could lead to the gold standard, or someone writes a paper about it. And some people buy gold based on their perception of an increase in the odds.

Monetary Metals has issued the first gold bond in 87 years, and has many more coming. When news of the return of gold bonds and the gold interest rate spreads more widely, it is possible that this will be perceived as a more credible path to remonetizing gold. And for every one investor who buys a gold bond there could be a thousand who buy gold itself.

This effect will obviously be small at first, and grow with the number and size of the gold bonds issued. We would not expect it to affect the price of gold in 2021, but we would not rule it out either. In 2022, it may get more interesting.

How Not to Predict the Gold Price

In the Outlook 2016, we addressed the belief that the money supply (i.e. quantity of dollars) drives the price of gold. Short answer: it doesn’t. In Outlook 2018, we showed that interest rates are not correlated with the price of gold.

Both of these ideas are very popular. If you think about it, the first one is obviously wrong. The Fed is always increasing the quantity of what it calls money. The gold price goes up, sideways, and down. The second just does not work either. The price of gold shot up during the period of rising interest rates in the 1970’s. Since 1981, the interest rate has been falling. During that time, the price of gold has gone up, sideways, and down.

These supposed correlations just don’t work.

That said, there is a connection between interest and gold. It’s just not a simple correlation. We will address that below.

First, we want to comment on two things that have many buzzing today. One, the fall of the dollar cannot be measured in euros, pounds, yuan, etc. These currencies are dollar-derivatives! When they go up, it does not indicate the dollar is going down. It indicates that the risk-on trade is back on. It indicates a boom, where market participants are borrowing dollars to exchange for other currencies to buy assets denominated in those currencies. This can either be to profit from a higher interest rate, or in the hopes of capital gains. In other words, the euro or pound is going up.

You cannot infer that because the euro is on a tear, that this means the dollar is going down and therefore gold will go up (just as the dollar cannot be measured in terms of euros, gold cannot be measured in terms of dollars).

What Drives the Gold Price

Excluding speculators, people buy and own gold for the long term because it is money. Nearly all of the gold ever mined in human history is still in human hands.

This is how you’d expect money to behave.

So of course lots and lots of people own some. If we want to try to predict the price, we want to look at change at the margin. Will those who own now have a reason to sell? And will those who do not own it have a reason to buy?

The first question is: why does someone own money? Basically, it’s because he does not want to be a creditor. There are two reasons for this: risk and interest that compensates savers for taking risk. Let’s first look at risk.

To own a paper dollar bill, one is a creditor of the Federal Reserve. If you think that the Fed’s paper is risk free (which it is defined to be by modern finance), then you have no reason to own gold. If you look at the Fed’s balance sheet, and wonder what happens as its cost of funding goes up and at the same time the yield of its portfolio remains flat and the value of assets is declining, then you see risk and hence have a reason to own gold.

To deposit that paper bill in a bank is to add bank credit risk on top of Fed credit risk. Once upon a time, the banks paid interest on deposits. But now, not so much.

An increased awareness of risks in the banking system causes people to buy gold, and hence the price rises.

Now let’s look at payment to creditors, otherwise known as interest. Everyone has a price he demands, in order to give up his money and extend credit. If the interest rate offered to him is below this preference, he will not want to lend.

Central banks have a prime directive: to make it cheaper for the government (and its cronies) to borrow, so it can spend in excess of revenues. It seems such a simple exercise. Just buy government bonds. Push up the price of the bond, and that means the interest rate goes down (rate is a strict mathematical inverse of price). Unfortunately, they set in motion a dynamic system characterized by resonance and positive feedback.

To picture resonance, watch this video of the collapse of the Tacoma Narrows Bridge. The wind gusted at the resonant frequency of the bridge structure.

To picture positive feedback, watch this video of a guitar lesson on how to make that sound at the beginning of Foxy Lady by Jimi Hendrix (you have to hold the guitar up to the amplifier in just the right way).

The central bank may be able to push down the rate of interest, at least initially. However, they have no control over the time preference of savers. Normally interest is above time preference. But if they push interest below, then the violated savers will take action. Suffice to say that in this state, they prefer to hoard commodities rather than buy the bond offering interest that’s too low (read Keith’s theory of interest and prices for the full detail). If gold is legally permissible to be hoarded, then it’s the best good for hoarding.

The last time interest was below time preference was in the 1970’s. And boy did the gold price rise during that decade. Not because the interest rate was rising per se, but because interest was below time preference. Alas, as interest rose, so did time preference. Like a ratchet.

We are looking at a spread—interest to time preference—and it cannot be measured directly, as there is no economic data series for marginal time preference or the marginal saver.

Notwithstanding the Fed’s recent toying with higher rates, we are still in the same falling trend ongoing since 1981. Each downtick in the interest rate may push it below some dollar holder’s time preference. These marginal dollar holders may buy gold.

Our Call

Gold closed the year 2020 around $1,900 (the Monetary Metals calculated gold fundamental price was a few hundred below that, but as we said earlier, we believe this is an artifact of the disruption due to Covid lockdowns and increasing regulatory pressure on bullion banks, and not an accurate fundamental price).

Silver closed the year around $26.50 (our calculated fundamental price was $23.72).

Every year, we note that fundamentals can and do change. And longer-term predictions demand more than just looking at the basis. We are trying to imagine what will happen after the Reddit threads about silver, after the rumors that buying silver will harm the banks subside (again), and after the momentum of the moment inevitably dwindles…..

Read the full Gold Outlook 2021, including our calls for the gold and silver prices (free registration required).

We are hiring! Do you have a passion for working on big problems that matter? Are you excited to keep the books in real money? We invite you to apply for the position of Senior Management Accountant. Please email a cover letter and resume to: [email protected]

© 2012-2021 Monetary Metals LLC. All Rights Reserved.