Silver buyers beware. This is not the silver breakout you're looking for. As the price of silver has risen from $24 to over $27, we look at who's buying.

Every once in a while, one regrets not acting sooner, not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Oh well. They are not calling for that, based on the same indicator we observe.

The silver basis.

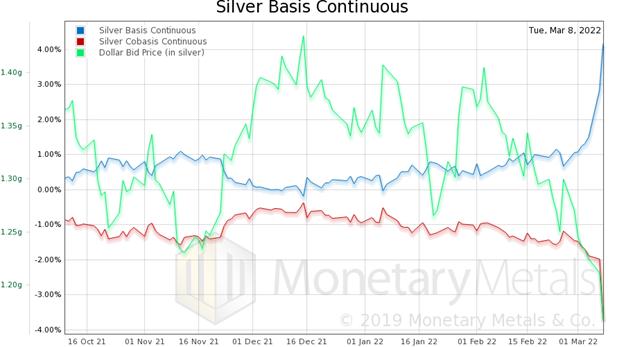

Here is the chart.

Silver Price Basis Chart

Look at that moonshot!

basis = future(bid) – spot(offer)

cobasis = spot(bid) – future(offer)

As the price has risen since February 25, from under $24, to yesterday around $27, the basis shot up. It went from 0.67% to 4.18%.

Silver Buyer Beware

Folks, it does not get any clearer than this. The big price rally in silver was driven by big buying of silver futures.

NOT physical metal.

This is not a bullish sign. Those who buy futures are playing with leverage. In the best of times, they will sell to take profits. And in volatile times, they may need to sell to cover margin calls. Even when the silver price is rising, they may have margin calls on other positions in their portfolio. Or they may just be more jittery. We discuss these market dynamics, including our price forecast for silver this year, in our free Gold Outlook 2022 Report.

Argentum emptor cave.*

*Silver buyer beware

© Monetary Metals 2022